lincoln ne sales tax calculator

Home is a 2 bed 20 bath property. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Your household income location filing status and number of personal exemptions.

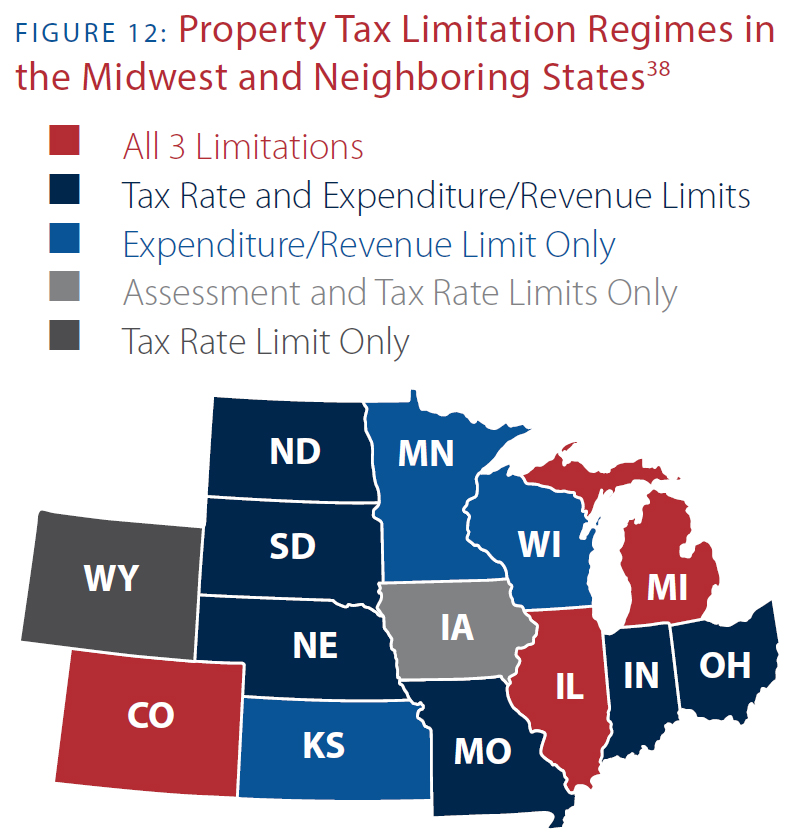

. In nebraskas largest counties however rates can occasionally exceed. The Nebraska sales tax rate is currently. Most transactions of goods or services between businesses are not subject to sales tax.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Lincoln Sales Tax Rates for 2023 Lincoln in Nebraska has a tax rate of 725 for 2023 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling. The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725.

SOLD MAY 27 2022. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832.

Nearby homes similar to 1828 Lincoln Rd NE have recently sold between 538K to 1550K at an average of 625 per square foot. The average cumulative sales tax rate in Lincoln County Nebraska is 583 with a range that spans from 55 to 7. The Nebraska state sales and use tax rate is 55 055.

The Nebraska NE state sales tax rate is currently 55. FilePay Your Return. View more property details sales history.

The sales tax rate for Lincoln was updated for the 2020 tax year this is the current sales tax rate we are using in the Lincoln Nebraska. This is the total of state county and city sales tax rates. Just enter the five-digit zip.

Sales and Use Taxes. This rate includes any state county city and local sales taxes. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling 175.

This rate includes any state county city and local sales taxes. Sales tax in Lincoln Nebraska is currently 725. 560000 Last Sold Price.

Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling 175. Sales Tax Rate Finder. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

The sales tax rate for Lincoln was. You can use our nebraska sales tax calculator to look up sales tax rates in nebraska by address zip code. 2020 rates included for use while preparing your income tax deduction.

This includes the rates on the state county city and special levels. 2028 NE 56th Dr Lincoln City OR 97367 is a single-family home listed for-sale at 625000. 2020 rates included for use while preparing your income tax deduction.

The sales tax rate for Lincoln was. The latest sales tax rate for Lincoln NE. This includes the rates on the state county city and special levels.

The latest sales tax rate for Lincoln County NE. Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated 09082022.

The Nebraska state sales and use tax rate is 55 055. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax.

Waste Reduction and Recycling Fee. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

7 875 Sales Tax Calculator Template

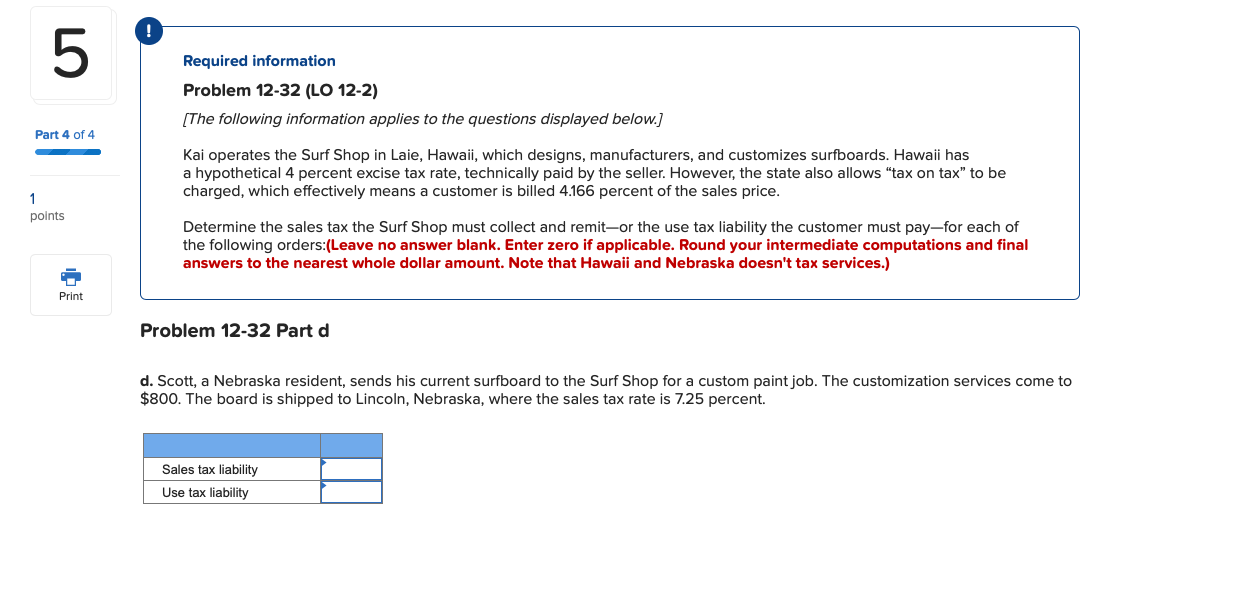

Solved Required Information Problem 12 32 Lo 12 2 The Chegg Com

Taxes And Spending In Nebraska

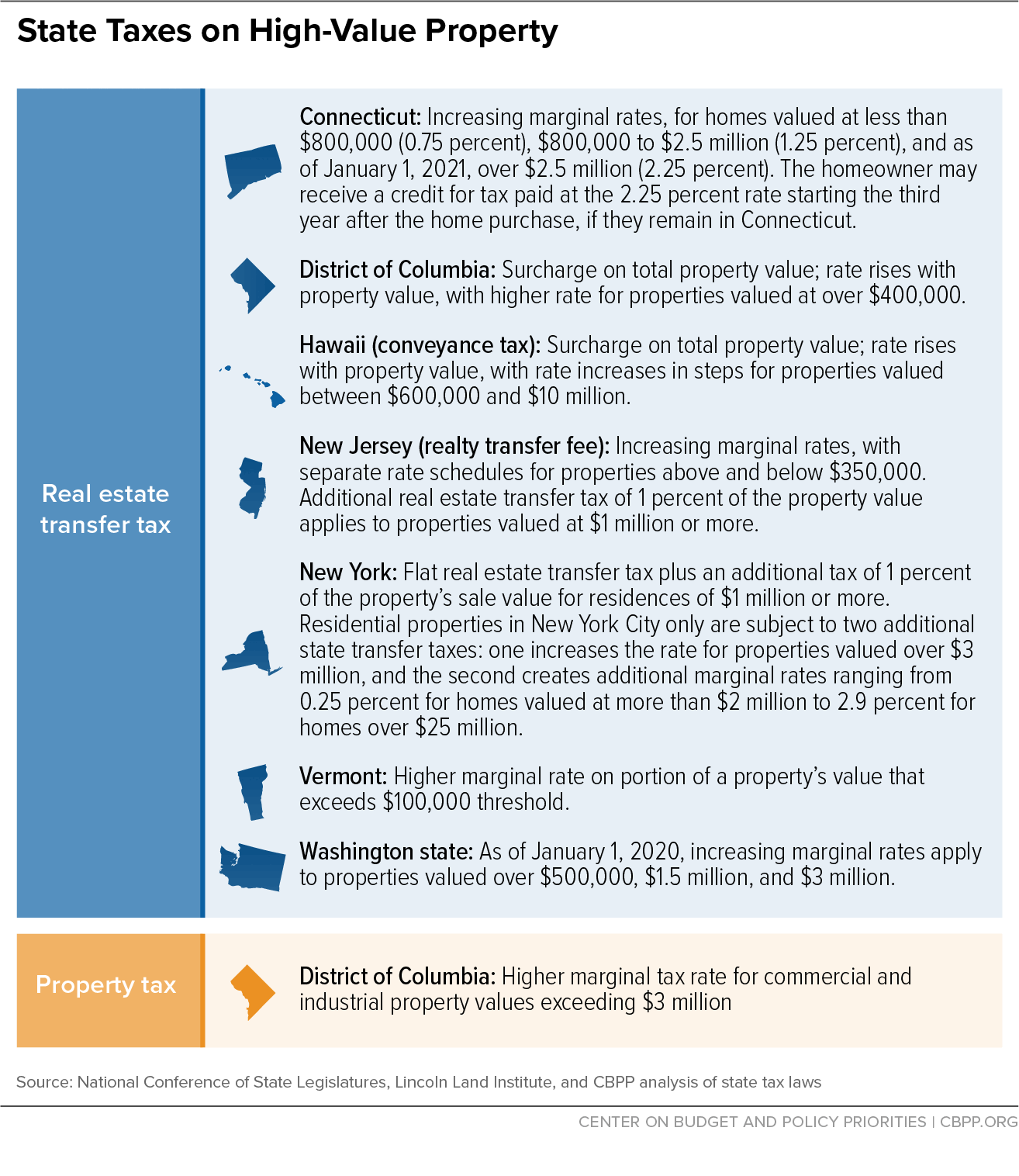

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

.png)

Job Opportunities Sorted By Job Title Ascending Good Life Great Opportunity

General Fund Receipts Nebraska Department Of Revenue

![]()

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Nebraska Income Tax Ne State Tax Calculator Community Tax