owner's draw in quickbooks self employed

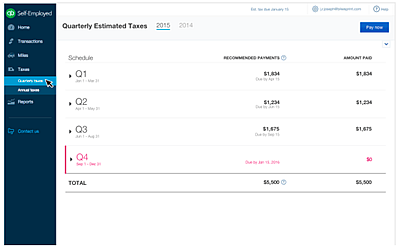

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. The draws do not include any kind of taxes including self.

Setup And Pay Owner S Draw In Quickbooks Online Desktop

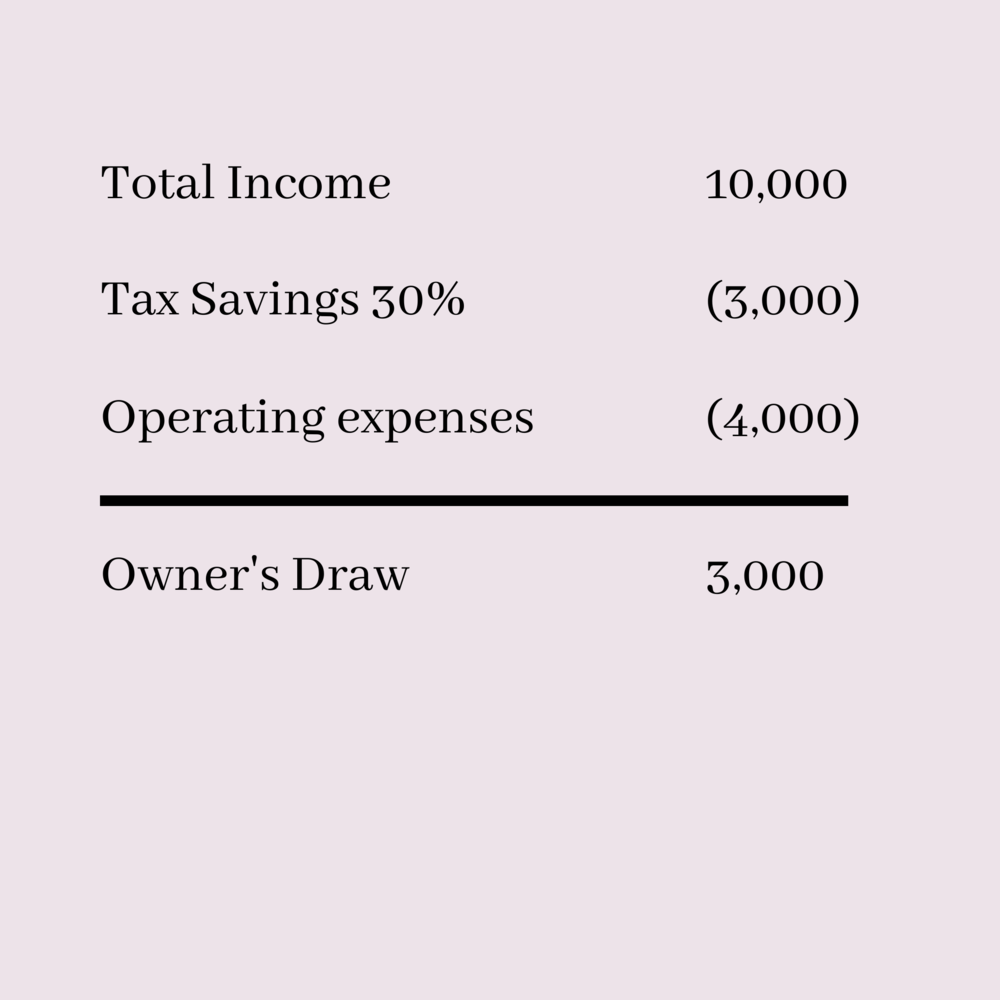

Owners draws also known as personal draws or draws allow business owners to withdraw money as needed and as profit allows.

. A draw may seem like a superior option. Create an Owners Equity account. Save Over 51 Hours Per Month On Average By Using QuickBooks.

Enter the payment and use owner equity drawing as the expense. Step 4 Click the Account field. A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company.

Create an Owners Equity account. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. For accounting purposes the draw is taken as a negative from their business.

If QuickBooks displays the Payments to Deposit. Select Make Deposits from the drop-down menu. Business owners generally take draws by writing a check to themselves from their business bank accounts.

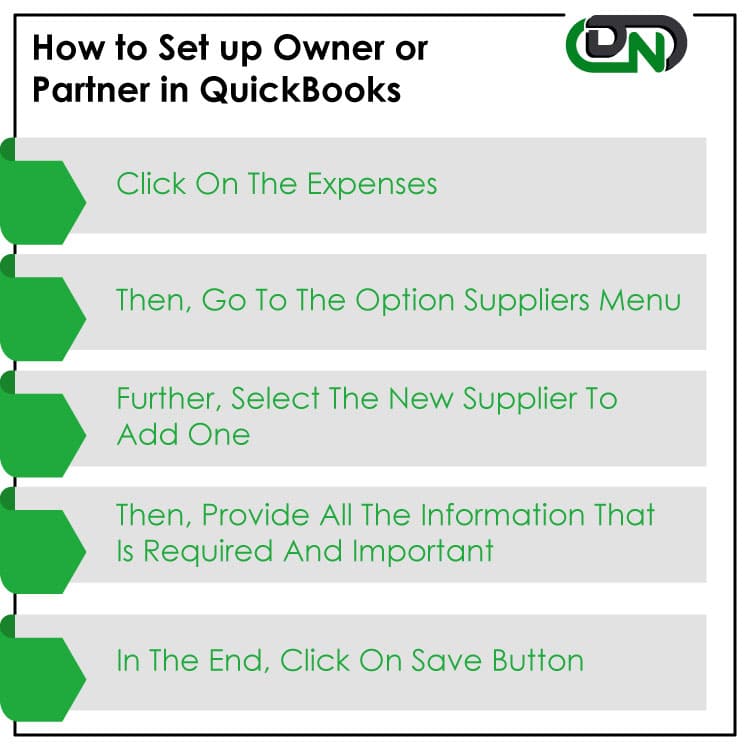

When you create your account be sure to. Click the Banking tab in the main menu bar at the top of the screen. Your Accountant Reconciles Owner Equity and Payroll Liabilities.

Setup and Pay Owners Draw in QuickBooks Desktop. Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. How to Create Owners Draw.

With our Owner Salary or Draw Posting Service your accountant reconciles your self-employment expenses. User can go with the mention procedures to Setup and Pay Owners Draw in QuickBooks Desktop edition. Before you can pay an owners draw you need to create an Owners Equity account first.

Quickbooksonline taxreturn financialgymQuickBooks Tutorial - How do you take your money out of your business that you need for your own living expenses an.

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

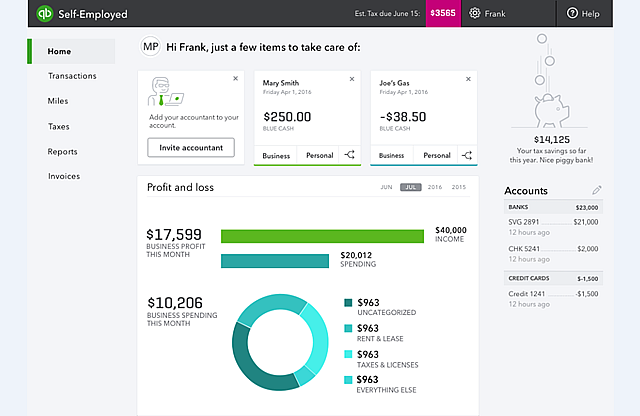

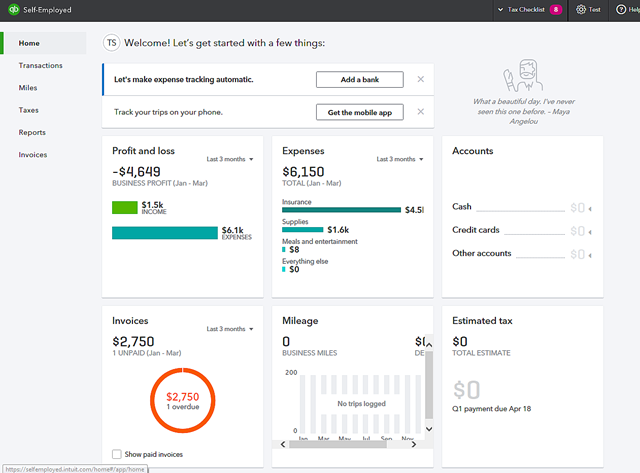

Quickbooks Self Employed Review 2022 Pricing Features Complaints

Intuit Sets New Integration With Quickbooks Online Accountant Insightfulaccountant Com

Trick To Separate Business From Personal Expenses In Quickbooks Go Get Geek

Business Owner Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Quickbooks Uk

I Just Received Ppp Loan Funds How Should I Set Up The Loan How Do I Track Owner Compensation By Ppp Loan Funds In Quickbooks Self Employed

What S The Scoop With Quickbooks Self Employed Insightfulaccountant Com

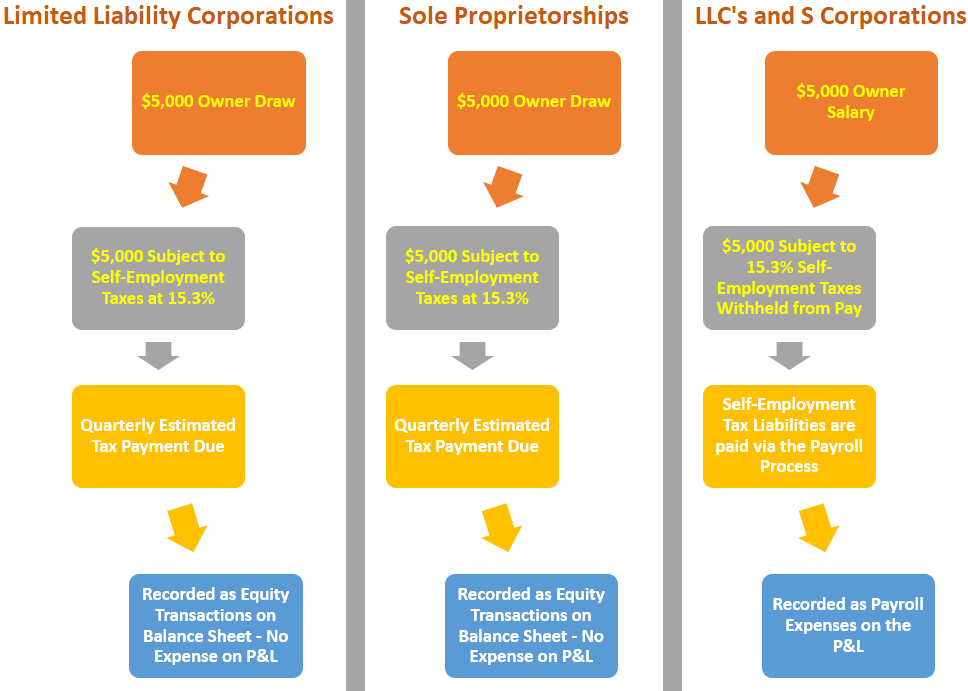

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

Owner Draw Vs Salary Paying Yourself As An Employer

Categorizing Transactions In Quickbooks Other Bookkeeping Software Network Antics

How To Complete An Owner S Draw In Quickbooks Online Qbo Tutorial Youtube

Quickbooks Self Employed Desktop Tutorials Quickbooks Self Employed

Quickbooks Online Vs Excel Do You Really Need Bookkeeping Software

Ultimate Guide To Blog Bookkeeping Using Quickbooks Online Small Business Sarah

How To Pay Yourself As A Business Owner In 2022 Tips For All Businesses

How Do You Pay Yourself As The Owner Of The Business Bookkeeping Network

How To Record Owner Investment In Quickbooks Set Up Equity Account

Quickbooks Self Employed Not Perfect But Better Than Nothing Insightfulaccountant Com

Quickbooks Self Employed Vs Small Business In 2022 Hustle To Startup